This week, we learned that employers experienced a 6.3% jump in health benefit costs last year.1 Findings such as these, paired with high brand-name drug costs, are why commercial and employer-sponsored health plans have long looked forward to savings from biosimilar competition. Unfortunately, employers soon will be facing higher costs, if provisions in the Build Back Better Act (BBB) that discourage biosimilar development are adopted by Congress. The competition that biosimilars create provides significant savings, totaling nearly $8 billion in 2020, and is projected to provide $133 billion in savings from 2021 to 2025,2 which is critically important to bending the drug cost curve for the 152 million patients covered by commercial plans in the United States.

Biosimilar competition is vital to reducing the costs of specialty medicines, most of which are biologics. These specialty medicines represent only a fraction of all prescriptions now, but account for about 53% of all pharmaceutical spending.3 And the biosimilar pipeline for competition against these high-cost therapies continues to grow, as there are more than 95 products under development today, a 50% increase in just two years.4 An example of the value of biosimilar competition is seen in oncology, where new biosimilar competition has helped caused spending growth to fall by nearly half in one year alone.5

But the Build Back Better proposal for HHS to dictate prices for 100 drugs or more by 2030, many of them brand-name biologics that are forecast to face robust biosimilar competition, undermines this progress and the promise of future savings, particularly for employers and patients in commercial health insurance markets.

In fact, if the proposal is enacted, it is likely that many of the biosimilars in development will no longer be commercially viable as a result of the significant uncertainty created by the BBB. This in turn would not only result in less savings to Medicare, but would deprive patients and payers in the commercial market of significant savings and leave them dependent on high cost brands.

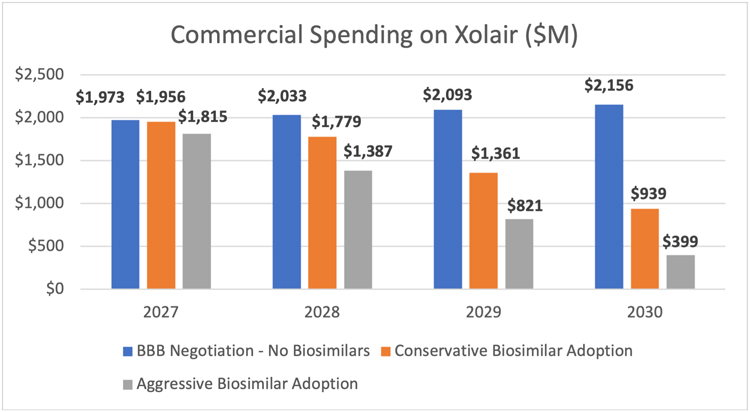

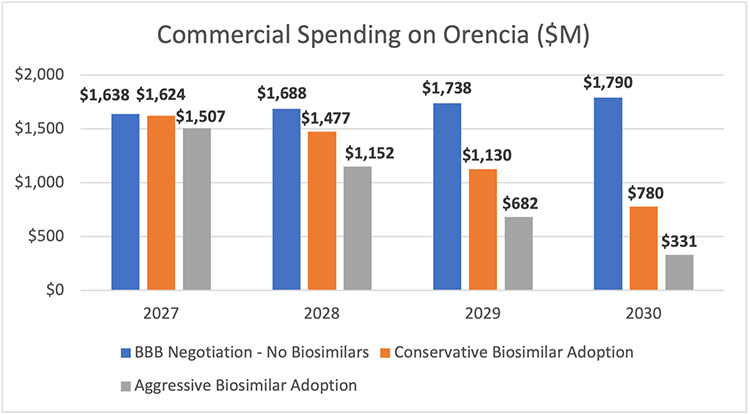

AAM’s Biosimilars Council assessed the potential lost savings to the commercial market using Xolair (omalizumab) and Orencia (abatacept) as examples. Used to treat asthma and rheumatoid arthritis, respectively, as well as other conditions, each of these products has total spending of around $2 billion.6

Assuming that these products are subject to the BBB negotiations beginning in 2027, the earliest year possible under the legislation, Medicare would save 60% - $309.8 million and $750.4 million each year - through lower spending on Xolair and Orencia, respectively. But the market uncertainty created by the legislation could undermine the willingness of biosimilar developers to invest the $100-$250 million and 8-12 years necessary to bring a lower-cost option to market.

AAM estimated the impact of the lack of biosimilar competition for these two products across a range of scenarios that included the average biosimilar market share for current biosimilar products and a more aggressive scenario that anticipates biosimilar adoption will continue to progress this decade. This analysis found that the legislation would cause patients and employers in the commercial insurance market to spend between $1.8 and $3.2 billion more on Orencia between 2027 and 2030 in the absence of biosimilar competition. For Xolair, the commercial market would spend between $2.2 and $3.8 billion more than it would if there were biosimilar competition.

Altogether, this would mean lost savings of between $4 billion and $7 billion between 2027-2030 for just two products. This is lost savings that will mean higher patient out of pocket costs and higher insurance premiums for employers and employees.

The BBB represents a misguided approach to reducing drug spending and would harm long-term opportunities for greater savings through the market-based competition that biosimilars and generics offer. The BBB scheme would leave many patients and the health care system overall worse off with fewer options for care and higher costs. Congress should instead focus on removing anticompetitive patent and market barriers to competition in order to bring lower-priced biosimilar and generic competition to market as early as possible for America’s patients.

Share Your Voice

Tell Congress to protect access to your safe, affordable generic and biosimilar medicines.

By Craig Burton, AAM Vice President, Policy

Published on December 20, 2021

References

- Mercer. (December 2021). National Survey of Employer-Sponsored Health Plans. (Link)

- IQVIA. (May 2021). The Use of Medicines in the U.S.: Spending and Usage Trends and Outlook to 2025. (Link).

- Ibid.

- FDA-TRACK: Center for Drug Evaluation & Research - Pre-Approval Safety Review - Biosimilars Dashboard (Link).

- IQVIA. (May 2021). The Use of Medicines in the U.S.: Spending and Usage Trends and Outlook to 2025.

- IQVIA. (October 2020). Biosimilars in the United States 2020–2024 Competition, Savings, and Sustainability. (Link).