By John Murphy III, President & CEO, AAM

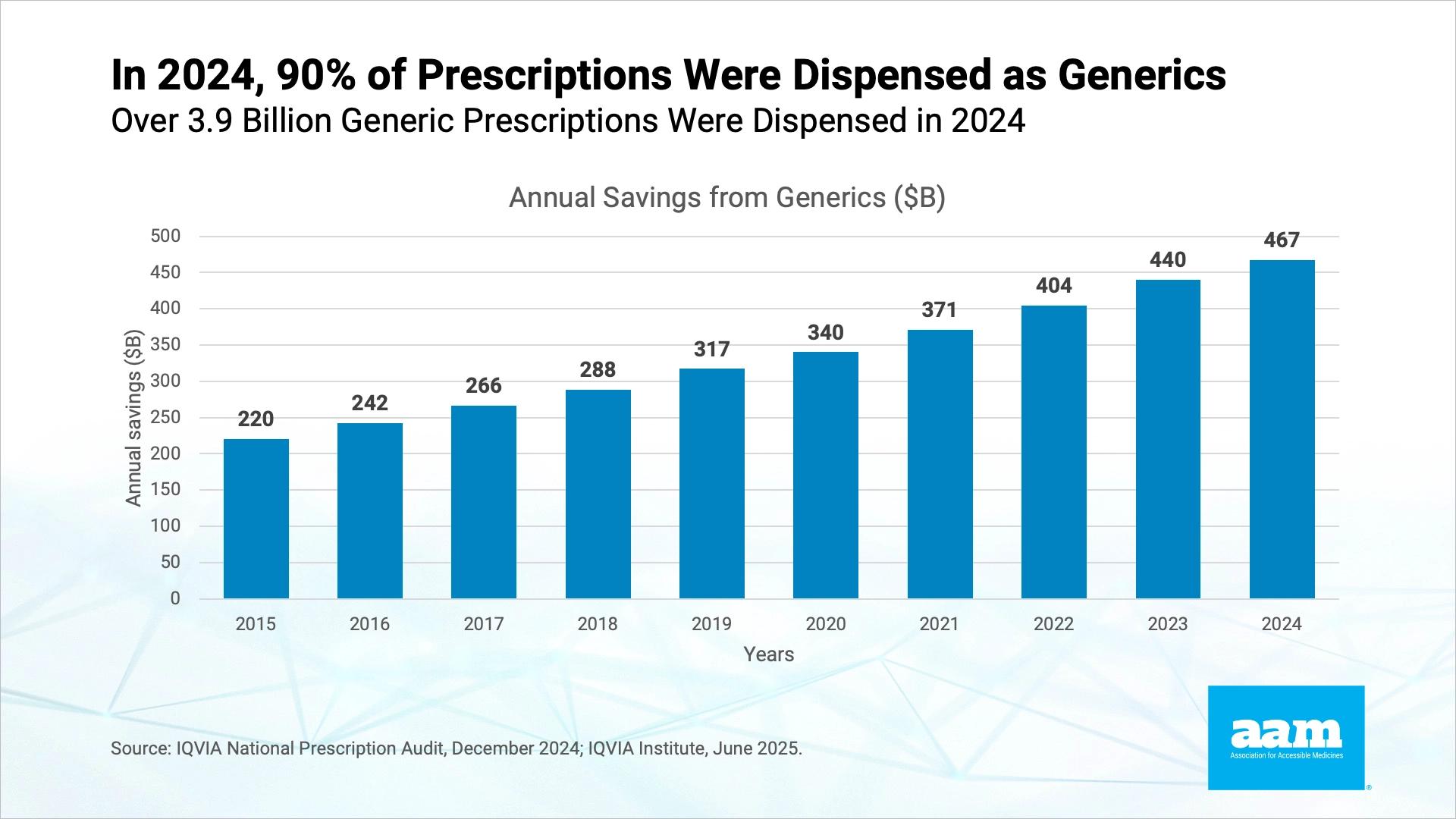

In 2024, generic and biosimilar medicines comprised 90 percent of all prescriptions filled, but only 12 percent of prescription spending. In sharp contrast, brand drugs supported patients less often—making up only 10 percent of prescriptions filled but adding up to 88 percent of the total drug spend. In other words, American’s spent only $98 billion filling 3.9 billion generic prescriptions and a whopping $700 billion filling just 435 million brand drug scripts. Simply put: brand drugs drive costs and generic medicines drive savings.

But let’s take this one step further. Generic medicines are the only sector that consistently result in decreased spending across the U.S. healthcare ecosystem. In fact, since 2019, the amount spent on all generic sales in the U.S. has declined by $6.4 billion, despite increased volume and new generic launches.1

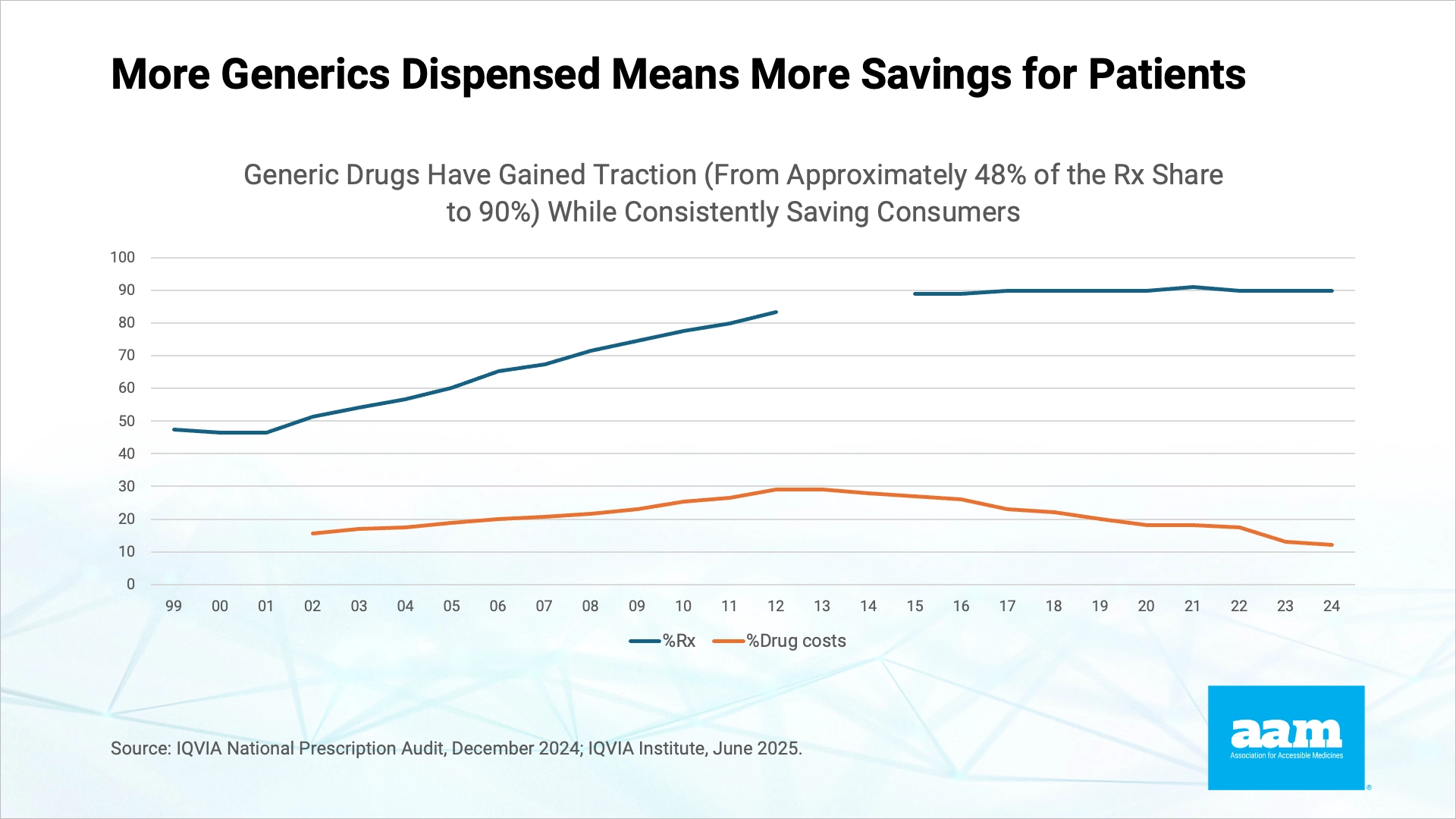

For over a decade, AAM has partnered with The IQVIA Institute to capture relevant data and help describe the value of generic and biosimilar medicines in the U.S. Despite the hype and the discussion about drug pricing, the data shows an alarming but consistent trend. And, unfortunately, it has been this way for the last decade. Since 2016, generic drugs have steadily made up 9 out of every 10 prescriptions filled, all the while their overall percentage of costs has declined – from 27 percent in 2016 to only 12 percent in 2024.2

Does this mean the number of available generic drugs has decreased? No! Americans are relying on increased quantities of these lower-priced, high-value medications. As noted in the graph below, with respect to generic oral solids (i.e., pills and capsules), the overall trend is an increased number of these products being prescribed and sold. In 2015, the total number of generic oral solids was approximately 167 billion. Within a decade (in 2024), that number increased to approximately 197 billion – a 15 percent increase. Over ten years, Americans were prescribed and received nearly 2 trillion generic oral solids. Keep in mind, this figure does not include a host of other products made by generic manufacturers (e.g., injectables, creams, etc.).

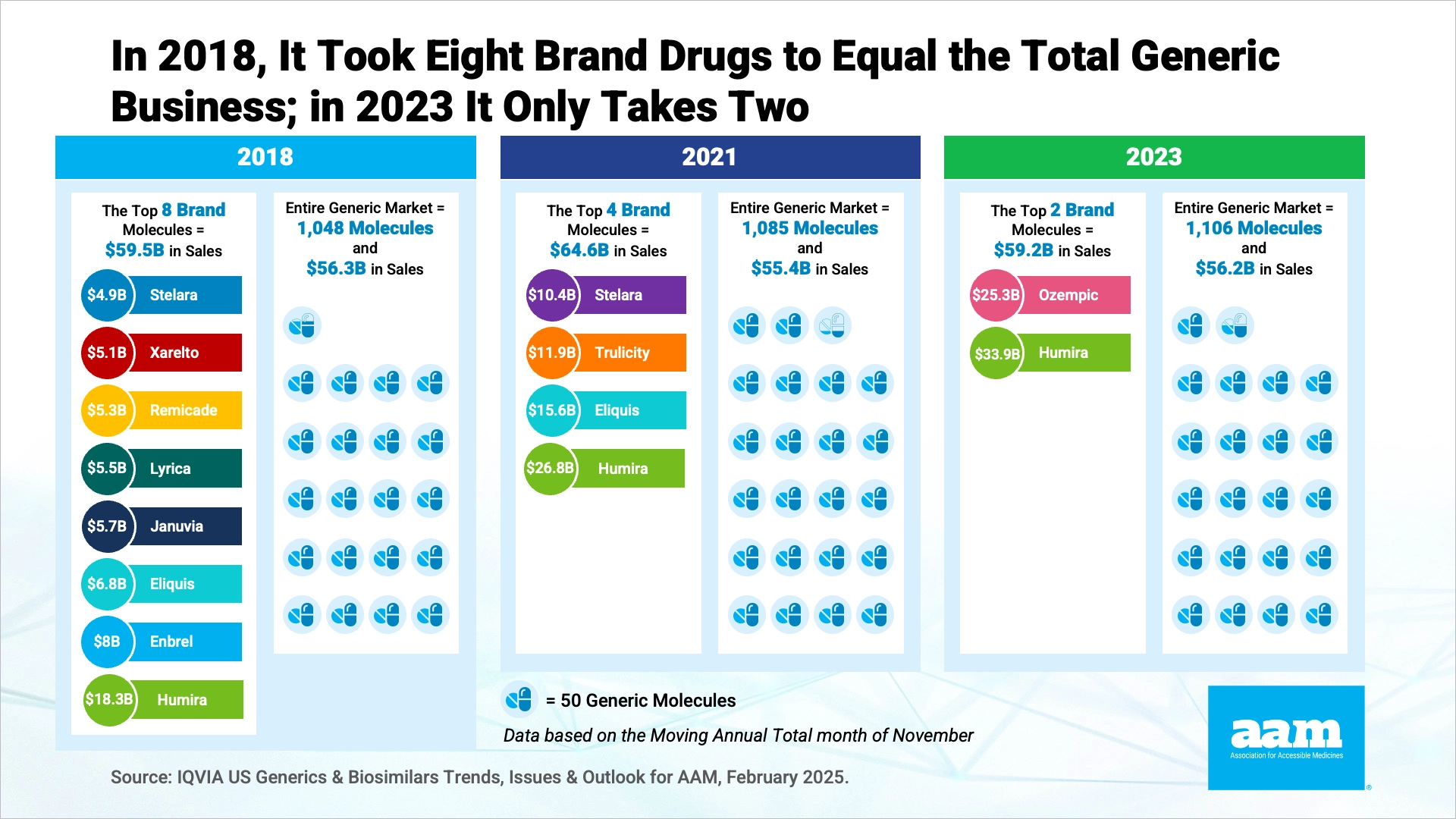

The question we must ask, then, is clear: Why are drug prices still increasing? While the overall price of generic medicines is consistently dropping, the overall price of brand drugs is consistently increasing. In fact, in 2018, the amount spent on eight different brand products equaled the total U.S. spending on ALL generic products.3 But flash forward to 2023 and we learn the sum of the amount spent on just two brand molecules – Ozempic and Humira – was greater than the total spent on 1,000 generic drugs combined.

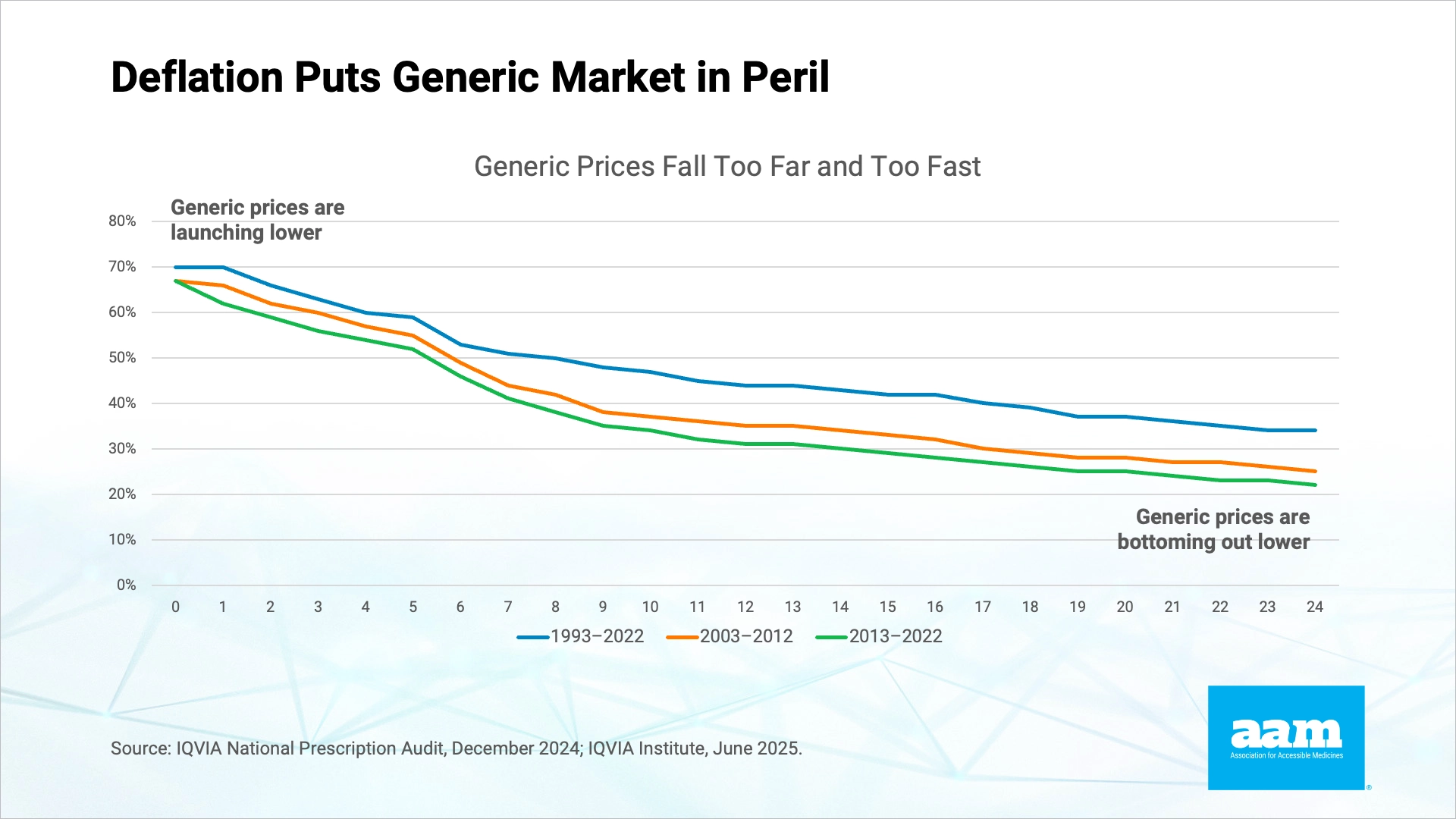

Perhaps most concerning is that, right now, little is being done to infuse sustainability into the generic medicines marketplace. As noted in the graph below, compared to 30 years ago, generic drugs are launching at lower prices and bottoming out at lower prices. The biggest change has been increased savings through the use of generic drugs. Three decades ago, generic prices tended to stabilize at approximately 34 percent of the brand product’s list price. But in the last decade, that percentage has continued to drop—to 22 percent. This type of deflation induces unsustainable market conditions for generic drug manufactures and, sadly, dangerously impacts the ability for America’s patients to receive affordable care.

While the data within our U.S. Generic & Biosimilar Medicines Savings Report clearly exposes dangerous market conditions and an industry in a current state of peril, solutions are not far out of reach. On behalf of AAM and our member companies, we urge policymakers to streamline FDA processes, curb patent abuse, stop PBMs and Medicare policies from denying patient access and rollback harmful federal policies – including IRA price controls.

Download 2025 U.S. Generic & Biosimilar Medicines Savings Report

References

- IQVIA Contributors. (May 2023). The Use of Medicines in the U.S. 2023. Accessible at: https://www.iqvia.com/insights/theiqviainstitute/reports-and-publications/reports/the-use-of-medicines-in-the-us-2023

- This data was compiled from various AAM/GPhA reports, including (a) GPhA (2006). Annual Report 2006, (b) GPhA. (2008) Celebrating the Past, Defining the Future: 25 Years of Affordable Medicines, (c) GPhA (2012) 2012 Annual Report, and (d) GPhA (2015) 2015 Annual Report.

- Long, D. (February 2024). US Generics & Biosimilars Trends, Issues & Outlook, IQVIA.