Blog originally released by the Biosimilars Council

Just two weeks ago, the U.S. biosimilars industry entered a new phase when eight biosimilar versions of Humira launched with prices reaching as low as 85 percent below the brand list price. Humira is the bestselling drug in the U.S., and new biosimilar competition represents a major expansion in patient access to treatment and savings. That said, the benefits to patients won’t materialize overnight.

But while observers wait for biosimilars to gain traction, and eventually deliver significant savings for patients, a new analysis conducted for the Biosimilars Council highlights broader challenges facing biosimilars as they come to market.

In late 2021, Semglee and its unbranded insulin glargine launched as the first pharmacy-distributed, fully interchangeable biosimilar. This is a biosimilar version of the blockbuster diabetes medication, Lantus, and can be substituted at the pharmacy counter.

Biosimilar Semglee is available at different prices. Semglee launched with a slight decrease in price and a high rebate, and its unbranded insulin glargine came in with a major (65 percent) price decrease. This allows pharmacy benefit managers (PBMs) creating drug formularies to choose between a higher list price that allows them to generate revenue from a high rebate or a significantly lower list price that results in lower costs to patients. Since a lower list price means lower costs for patients, the choice would seem obvious. But an independent analysis last year found that PBMs largely chose the higher-priced version.

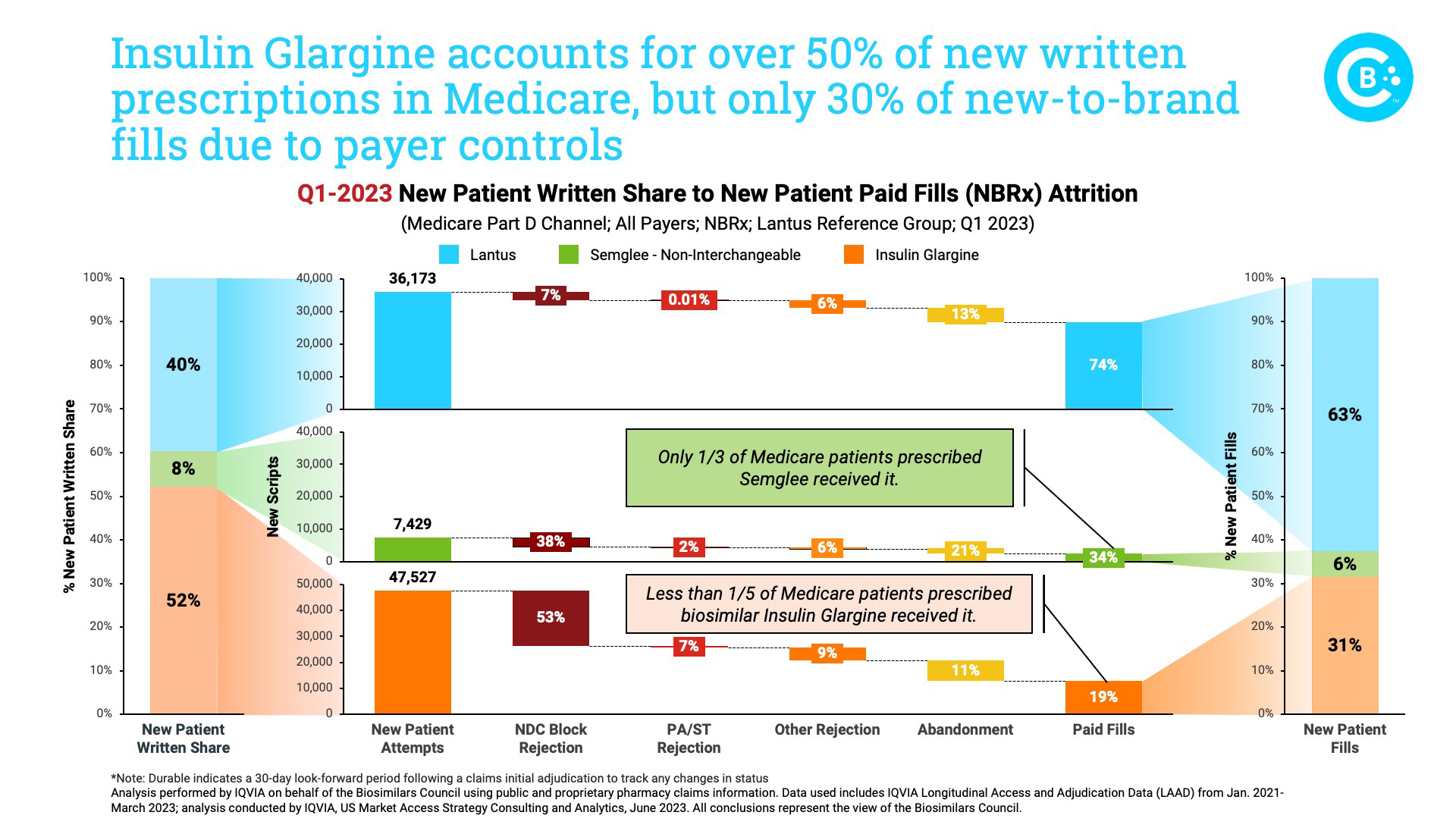

This updated review of the biosimilar insulin market, performed by IQVIA on behalf of the Biosimilars Council, demonstrates the extent to which PBM decisions conflict with physicians’ and patients’ interests. For example, more than half of all prescriptions were written for the low-cost unbranded Insulin Glargine, but it accounted for less than one-third of those filled. In fact, if not for PBM formulary controls, six out of every 10 prescriptions Lantus or its biosimilars would be filled by a biosimilar. The rejection of biosimilars in favor of the brand is most prominent in the Medicare market.

And further examination of specific payers highlights these concerns. Among four payers that account for almost two-thirds of all newly written insulin glargine prescriptions in Medicare, three completely cover the brand. Meanwhile, the lower-priced biosimilars are either blocked or only partially covered.

Too many formulary decisions are being made based on the value to the payer, not the benefit to the patient. This is a direct result of the perverse incentives favoring use of higher cost medicines, and it leads one to question the benefit of developing lower cost medicines.

The Inflation Reduction Act made notable changes to plan liability in the Medicare program with the goal of encouraging greater use of lower cost medicines. But its reforms are insufficient and do not address the core incentives that undermine patient access to lower cost medicines.

The recently proposed Ensuring Access to Lower-Cost Medicines for Seniors Act, addresses this challenge head-on. It ensures that patients have access to new generics and biosimilars with lower prices, and it encourages broad competition that will benefits patients, taxpayers, employers and payers alike.

A thriving biosimilars market means greater access to health care for America’s patients. It’s time to get rid of incentives rewarding use of higher-priced medicines and ensure that patients realize the value of competition from lower-cost generics and biosimilars.

By Craig Burton, Senior Vice President, Policy and Strategic Alliances

Executive Director, Biosimilars Council

Published on July 17, 2023