Avalere analysis finds Part D prescription drug plans continue to increase patient copays for generics by moving them to higher tiers

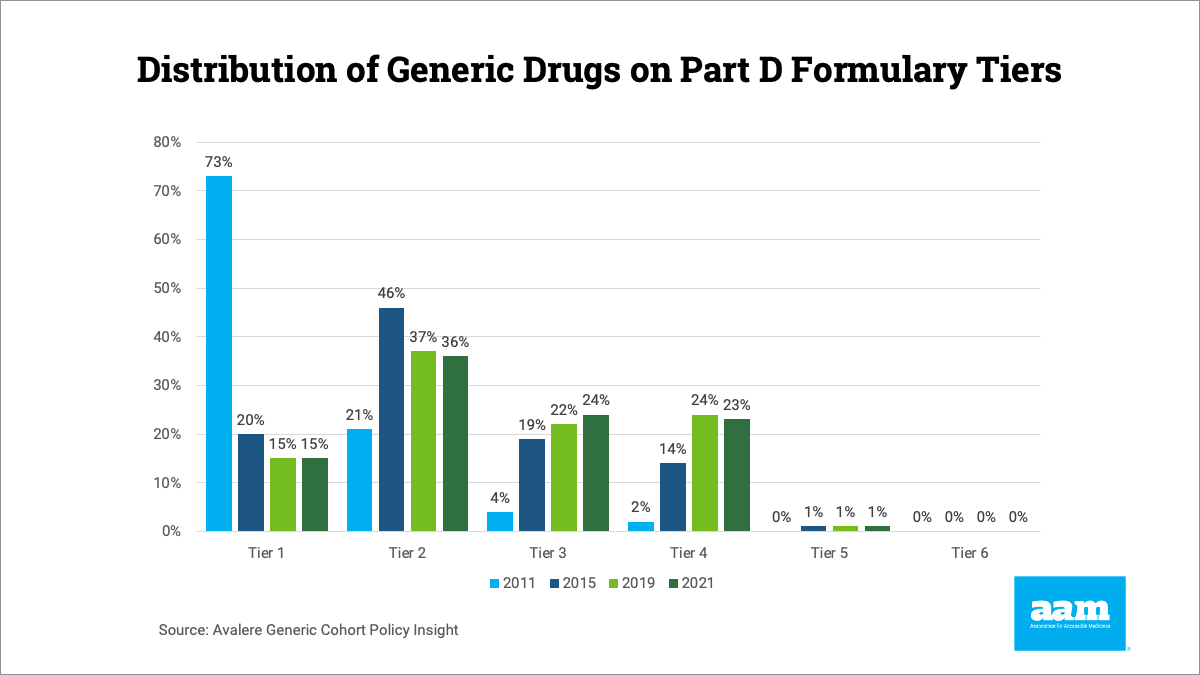

WASHINGTON (April 17, 2024) — The Association for Accessible Medicines, the leading trade association for generic and biosimilar manufacturers, commented on an analysis released yesterday by Avalere showing that Medicare plans increase patient costs for generic medicines by moving those medicines to more expensive formulary tiers. In 2011, 73% of generic drugs analyzed by Avalere were placed on Tier 1, which has a zero-dollar copay on average. Ten years later, only 15% of those drugs were still on Tier 1, despite the average price of those medicines falling by 38% between 2011 and 2019.

Despite overall prices for generic medicines continuing to drop, Avalere’s analysis shows that prices paid by seniors in Medicare plans continue to increase due to health plans moving generics to higher tiers with higher co-pays

said David Gaugh, Interim President & CEO of AAM. PBMs are blocking patients from the benefits of lower costing generic and biosimilar medicines. Congress, the Administration, and regulators should be asking why safe, effective, long-standing generic medicines are being moved to higher cost tiers instead of the other way around.

AAM released a blog with their analysis of the Avalere data or download a PDF below.

For media inquiries, contact the Communications department at media@accessiblemeds.org.

About AAM

The Association for Accessible Medicines, your generics and biosimilars industry, is driven by the belief that access to safe, quality, effective medicine has a tremendous impact on a person’s life and the world around them. Generic and biosimilar medicines improve people’s lives, improving society and the economy in turn. AAM represents the manufacturers of finished generic pharmaceuticals and biosimilars, manufacturers of bulk pharmaceutical chemicals, and suppliers of other goods and services to the generic industry. Generic pharmaceuticals are 90 percent of prescriptions dispensed in the U.S. but only 17.5 percent of total drug spending.

About the Biosimilars Council

The Biosimilars Council, a division of the Association for Accessible Medicines (AAM), works to ensure a positive environment for patient access to biosimilar medicines. The Biosimilars Council is a leading source for information about the safety and efficacy of more affordable alternatives to costly brand biologic medicines. Areas of focus include public and health expert education, strategic partnerships, government affairs, legal affairs and regulatory policy. More information is available at www.biosimilarscouncil.org.