Introduction

Generic medicines play a key role in reducing costs and increasing patient access, saving the U.S. health care system $313 billion in 2019 alone and close to $2.2 trillion over the last decade.1 New generic entrants benefit patients and the health care system by introducing competition for high-priced drugs. However, new evidence confirms that the Medicare Part D Program continues to underperform compared to commercial plans in providing patient access to generic medicines.

The Association for Accessible Medicines (AAM) previously found that new generics approved by FDA between 2016 and 2018 faced significant delays in Medicare Part D formulary coverage when compared with commercial plans and are routinely placed on expensive brand tiers with high patient cost-sharing.2 These “first” generics are approved by FDA as the first generic competition, often to high-priced brand monopoly drugs. In 2020, 72 first generics were approved, providing access to lower-cost therapies that treat a wide range of medical conditions where little or no competition previously existed. They typically enter the market at a discount between 40–60%, offering important savings for patients. Despite their lower cost, they face delays in coverage by Medicare Part D plans, primarily due to skewed incentives in the current Medicare Part D Program, including the design of the Coverage Gap Discount Program (CGDP) and high federal liability in the catastrophic phase of the benefit. Collectively, these features incentivize Part D plans to use higher-priced brand drugs that provide larger coverage gap discounts and more quickly push patients through to catastrophic coverage, where the federal government assumes a greater proportion of the cost. As Congress considers Part D reforms, it is important to ensure these design flaws are not replicated in any new structure for the Part D benefit.

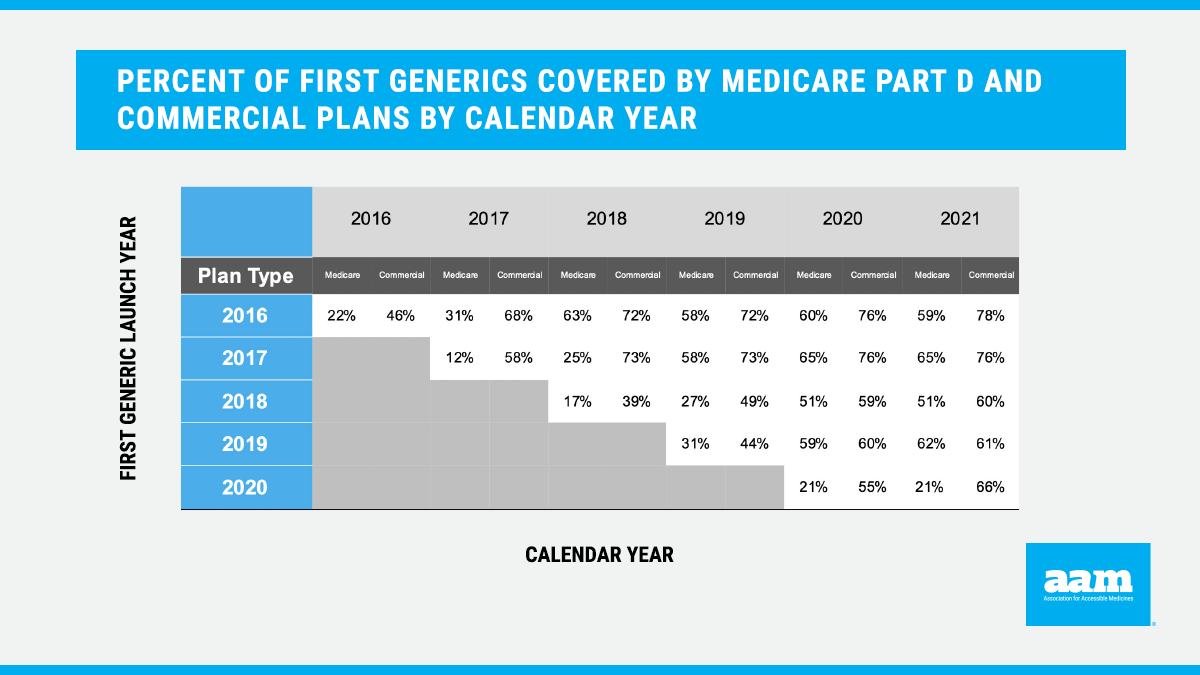

An updated analysis including first generics approved in 2019-2020 demonstrates that these concerning trends are continuing, preventing patients from realizing the benefits of first generic competition. Patients are often denied access to these needed medications — on average, newly approved first generics launched in 2020 are covered by only 21% of Medicare Part D plans. When first generics were covered, they were placed on non-generic tiers 79% of the time, exposing seniors to higher out-of-pocket costs. In comparison, an average of 66% of commercial plans are covering first generics launched in 2020. Significantly, tier placement was vastly better in the commercial market than in Medicare Part D, with first generics covered on generic tiers 98% the time.

There’s simply no justification for providing America’s seniors worse access to lower-cost generics than beneficiaries in commercial health plans receive. The system prevents seniors from getting the full value of their Part D benefit. Policymakers should modernize Medicare Part D, remove policies that discourage use of lower-cost medicines and enact strong incentives for generic adoption.

Findings:

Medicare Part D Plans Are Notably Slower Than Commercial Plans in Coverage of First Generics

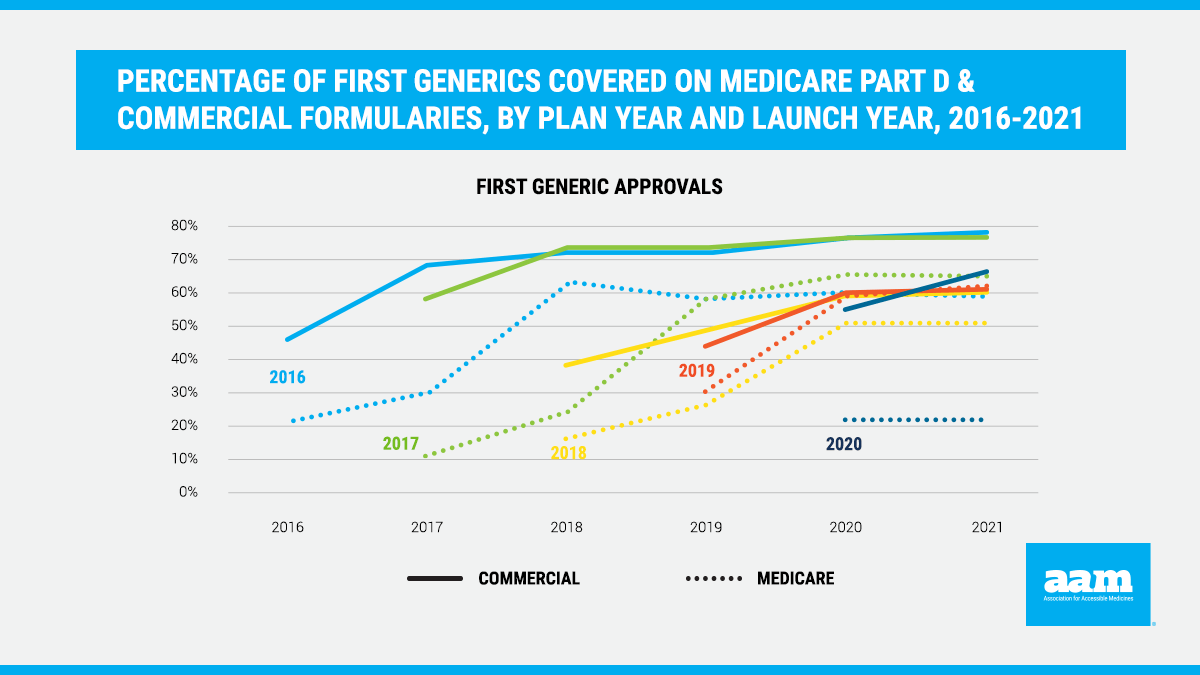

New data demonstrate that first generics continue to be disadvantaged in Medicare Part D in 2021. For the 2021 Medicare Part D plan year, on average, only 21% of first generics that launched in 2020 were covered by plan formularies (Figure 1). Consistent with previous years, the analysis found that it takes nearly three years before first generics are covered on more than half of Medicare Part D formularies. Even after this “phase-in” period, the data demonstrate that coverage in Medicare Part D for first generics is, on average, significantly worse than coverage in the commercial market. This delay and lack of coverage restricts patient access to lower-cost generics, denying patients savings in favor of unnecessarily high cost-sharing for brand medications even though lower-cost alternatives are available.

Even When First Generics Are Covered, Medicare Part D Plans Are Less Likely to Place Them on Generic Tiers

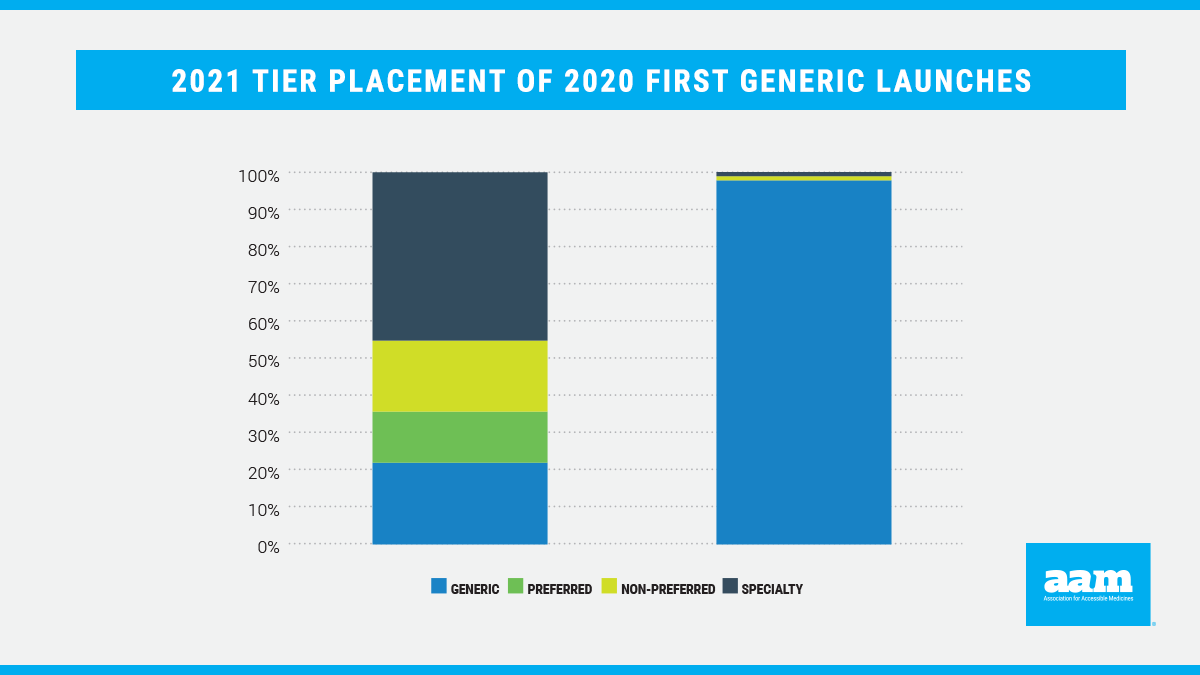

While formulary coverage is an important step to guarantee patient access to more affordable prescription drugs, tier placement continues to be a barrier. Proper tier placement is critical to realizing the full value of generic drugs and incentivizing generic competition. Pharmaceuticals on higher tiers are typically subject to higher patient cost-sharing than those on generic tiers. However, analyses continue to demonstrate that even when Medicare Part D plans cover first generics, they consistently place these products on non-generic brand tiers with higher cost-sharing (Figure 2).

In contrast, commercial plans also consistently place first generic medicines on lower-cost tiers. In 2021, 98% of covered 2020 first generics were placed on generic tiers by commercial plans. This is further evidence that the current Part D program structure is creating generic access and tier placement distortions.

Policymakers Can Ensure Seniors and Taxpayers Get the Full Value of Generics in Part D

For both commercial and Part D plans there are some structural incentives, including the aggressive use of brand rebates, that impede patient access to new generics at launch and result in higher patient costs through improper tier placement. However, these barriers are amplified in Medicare, where the structure of the Part D benefit undermines patient adoption, harming generic competition and depriving patients of access to lower-cost medicines.

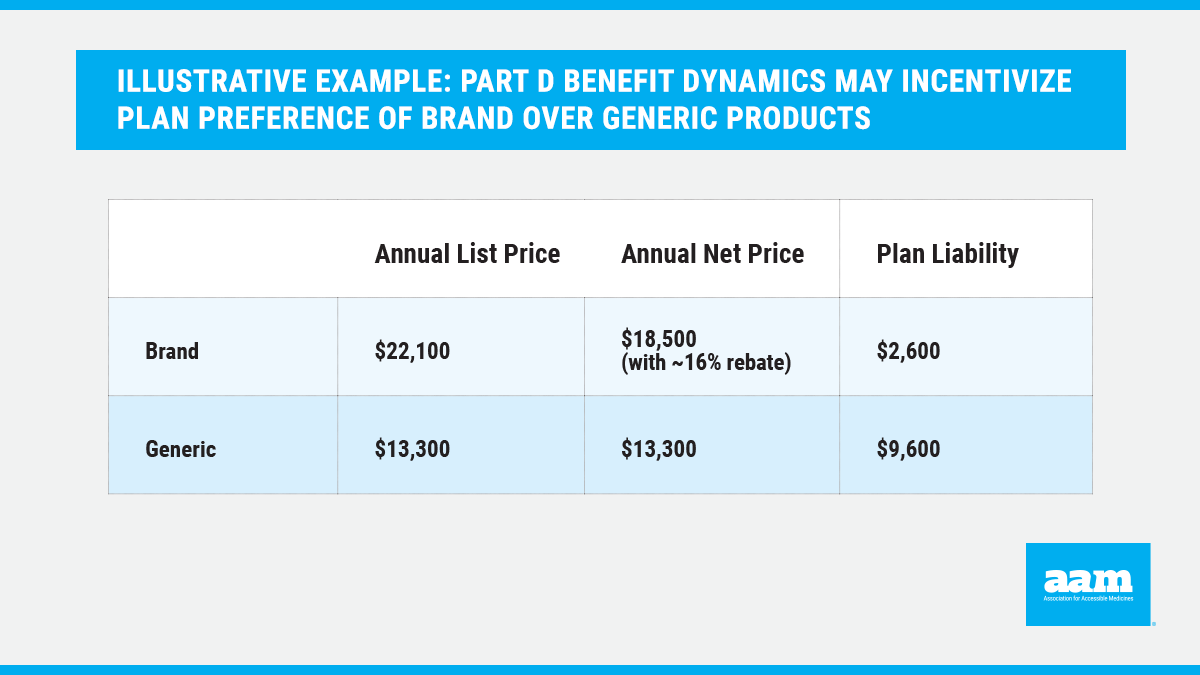

Specifically, the design of the Coverage Gap Discount Program (CGDP), which requires brand drug manufacturers to provide 70% discounts on drugs dispensed in the coverage gap and treats those discounts as out-of-pocket spending, creates a perverse incentive for a plan to lower its financial liabilities by preferring higher-priced brand drugs.3 By categorizing brand drug discounts as patient spending, the CGDP effectively moves a high-cost patient through the coverage gap and into the catastrophic phase of the benefit more quickly. In the catastrophic phase, the government subsidizes the remaining and largest portion of drug costs. This is a powerful incentive for plans to advantage higher-cost brand drugs over generics, even when those generics cost less and even if it means the Medicare program will pay more.

In this illustrative example,4 Part D benefit dynamics may result in $7,000 less in annual plan liability for the branded product compared to the generic, despite the brand being higher cost even with a rebate. Such Part D benefit dynamics include acceleration of beneficiaries into the catastrophic phase of the benefit when taking a brand drug as opposed to a generic alternative. As a result, plans may benefit from use of higher-cost products.

As Congress considers reforms to modernize Medicare Part D, policymakers should correct perverse incentives and expand access to new, lower-cost generics. Specifically, policymakers should prioritize the following to ensure patient access to lower-cost generics:

- Eliminate the Coverage Gap Discount Program and prohibit mandatory brand discounts from counting toward patient out-of-pocket spending.

- Incentivize the use of lower-cost medicines by decreasing plan liability for biosimilars and generics, relative to the reference brand.

- Align plan incentives for using low-cost products by decreasing government reinsurance and increasing plan liability in the catastrophic phase.

- Require Part D plans to review first generics and biosimilars within a specified time frame and provide written justifications to CMS if they are not placed on formulary after that review.

- Create a preferred specialty tier for generic and biosimilar products with lower cost-sharing.

- Prohibit or restrict plans’ ability to place generic drugs on non-generic tiers.

These changes will meaningfully reduce out-of-pocket costs for Part D beneficiaries and increase savings for taxpayers and the Medicare program overall.

Methodology:

This analysis was conducted on drug formulary and benefit design data from Managed Markets Insight & Technology, LLC (MMIT) to assess drug coverage and tier placement in the commercial market for first generics approved by FDA and commercialized since 2016. The data represents, across all markets, 98% of covered lives in the U.S. and comprises more than 600 commercial formularies in any given year. Tier placement was examined annually using data from December for 2016-2020 and September for 2021. To facilitate tier placement analysis across plans with different tier structures, the data is standardized from a product’s raw status (tier number or name given by the plan) into a “universal” tier status, which standardizes formularies into four tiers: Generic, Preferred Brand, Non-Preferred Brand and Specialty. The average percent of times the drugs are covered in each plan year were computed across products from each launch year using plan-product combinations from 2016-2019. For products covered each year, by launch year, the analysis assessed the average percent of times the drugs are covered on specific tiers: Generic, Preferred Brand, Non-Preferred Brand and Specialty.

Appendix

References

- Association for Accessible Medicines. 2020 Generic Drug and Biosimilars Access and Savings in the U.S. Report. /wp-content/uploads/2024/12/AAM-2020-Generics-Biosimilars-Access-Savings-Report-US-Web.pdf.

- Association for Accessible Medicines. Medicare and Commercial Plans Fail to Get New Generics to Patients. /wp-content/uploads/2024/12/AAM-White-Paper-Medicare-Part-D-New-Generics-to-Seniors-web.pdf.

- Medicare Payment Advisory Commission (MedPAC). (April 30, 2019). Statement of James E. Mathews, PhD. “Payment policy for prescription drugs under Medicare Part B and Part D.” Before the Subcommittee on Health Committee on Energy and Commerce U.S. House of Representatives Medicare Payment Advisory Commission (MedPAC). “Chapter 14: Status Report on the Medicare Prescription Drug Program (Part D).” Report to the Congress: Medicare Payment Policy, March 2017. http://medpac.gov/docs/default-source/reports/mar17_entirereport.pdf.

- Example assumes beneficiary annual spending limited to one brand or generic product during the 2020 coverage year.