Recently, the Centers for Medicare & Medicaid Services (CMS) released the 2021-2030 National Health Expenditure (NHE) report, prepared by their Office of the Actuary. The report serves as the authoritative estimate of total U.S. health spending and provides important clues as to what is (and is not) driving health care costs.1

CMS found that national spending increased by almost 10% last year and forecasts overall spending on health care to average 5.1% of the further growth between 2021 and 2030, ultimately reaching nearly $6.8 trillion. In particular, it projects Medicare spending to increase by an average rate of more than 7% between 2021 and 2030, and total household out of pocket spending on health care to increase greater than 41%.

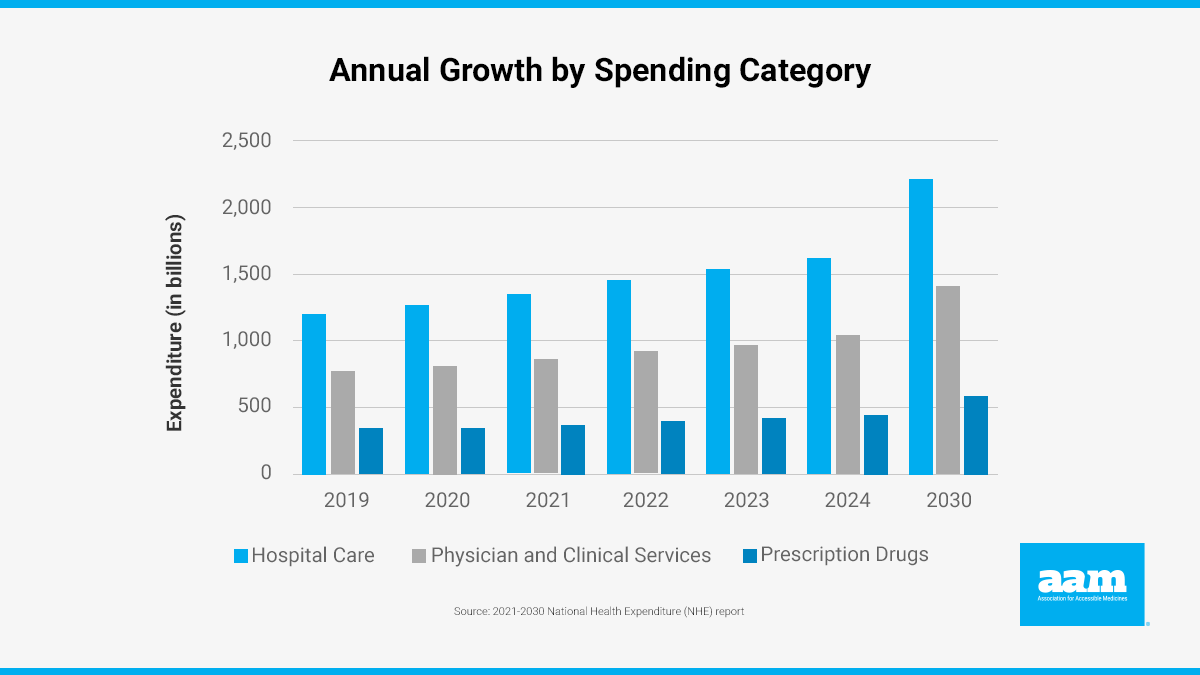

Hospital Care and Doctor Services Drive the Most Spending

As illustrated below, the drivers of this spending have been hospital care and physician/clinical services. Together, these two categories account for more than half of all spending. Today, hospital care and physician/clinical services account for 31% and 20%, respectively, of health care spending growth – compared to prescription drugs, which accounted for 6%.

According to CMS’ projections, hospital care and physician/clinical services are also expected to be the two largest drivers of expense growth through 2030. Specifically, CMS estimates that hospital costs will contribute a total of 38% of expenditure growth for all of healthcare. Physician/clinical services are expected to be the second largest driver of healthcare consumption expenditures contributing 24% of total growth.

Moreover, while expenditures for both spending categories is expected to be higher than that of prescription drugs, their rate of increase also accelerates faster. Overall, the average annual growth rate increases to nearly 6% for both categories, where the rate of increase for prescription drugs ranges from 3-5%. In fact, from 2021 to 2022, hospital spending growth is projected to accelerate substantially from 5.7 to 6.9 percent while during that same time period prescription drug spending is expected to decrease from 4.7 to 4.3%.2

Generics and Biosimilar Medicines Bend the Cost Curve

Notably, CMS projects health care spending to be moderated by the availability of generic and biosimilar competition. This is consistent with forecasts from IQVIA that predict biosimilar savings of $130 billion by 2025, including dramatically reducing the cost growth curve for medicines to treat cancer and autoimmune conditions.3

In fact, the report reveals that generic and biosimilar medications – which account for more than 90% of all prescriptions in the US but only represent 18% of prescription drug spending – are less than 3% of total U.S. health care spending. Broadly, the health care system has saved nearly $2.4 trillion in the last 10 years due to the availability of affordable generics.

Drug prices are often the focus of policymakers, but the updated CMS data paints a different picture. The report shows the slower growth in retail prescription drug spending has moderated the overall growth in NHE since 2015 and is projected to continue moderating through 2030. Moreover, prices for generic drugs have followed a deflationary pattern for the last six years.

Where economic growth is expected to outpace health spending growth for the period in this report, generic and biosimilar drugs offer competitive, high-value options for patients to save money. Despite increasing inflation, uncertainty within the supply chain and unpredictable levels of insurance enrollment, generics and biosimilars are a proven solution for policymakers seeking opportunities to maximize savings and increase values. Rather than unfoundedly including generics and biosimilars in state and federal proposals for drug price controls, negotiations or reporting that threaten the sustainability of the sector holding down health care cost growth, policymakers should focus their efforts on the true drivers of cost growth.

By Monét Stanford, Director, Policy

Published on April 19, 2022

References

- “National health expenditure projections: modest annual growth until coverage expands and economic growth accelerates.” Medical Benefits, vol. 29, no. 16, 30 Aug. 2012, pp. 1+. Gale General OneFile, link.gale.com/apps/doc/A300443872/ITOF?u=upenn_main&sid=summon&xid=29ce9e8d. Accessed 30 Mar. 2022.

- Poisal, John A et al. “National Health Expenditure Projections, 2021–30: Growth To Moderate As COVID-19 Impacts Wane.” Health affairs. 41.4 (2022): 474–486. Web.

- IQVIA Institute. (May 27, 2021). “The Use of Medicines in the U.S. Spending and Usage Trends and Outlook to 2025”. https://www.iqvia.com/insights/the-iqvia-institute/reports/the-use-of-medicines-in-the-us.

- Association for Accessible Medicines., 2021 Report: U.S. Generic and Biosimilar Medicines Savings Report, October 2021, Available at: https://accessiblemeds.org/resources/blog/2021-savings-report