Each year, the Association for Accessible Medicines releases a savings report that highlights where and how generic and biosimilar drugs save the US health care system hundreds of billions of dollars – over $338 billion in 2021. Since the report’s inception, generics and biosimilars have overwhelmingly been the lion share of prescriptions dispensed but the smallest portion of drug spend.

Last Thursday, IQVIA’s released a report titled The Use of Medicines in the U.S. 2022 Usage And Spending Trends And Outlook To 2026 that demonstrates the continuation of this trend while highlighting a startling fact: generic prices are falling, but patients are spending more on generics. A metric used to determine pricing called invoice level spending, also referred to as invoice-based pricing or list prices, is derived directly from proprietary information gathered from wholesalers and company direct sales.

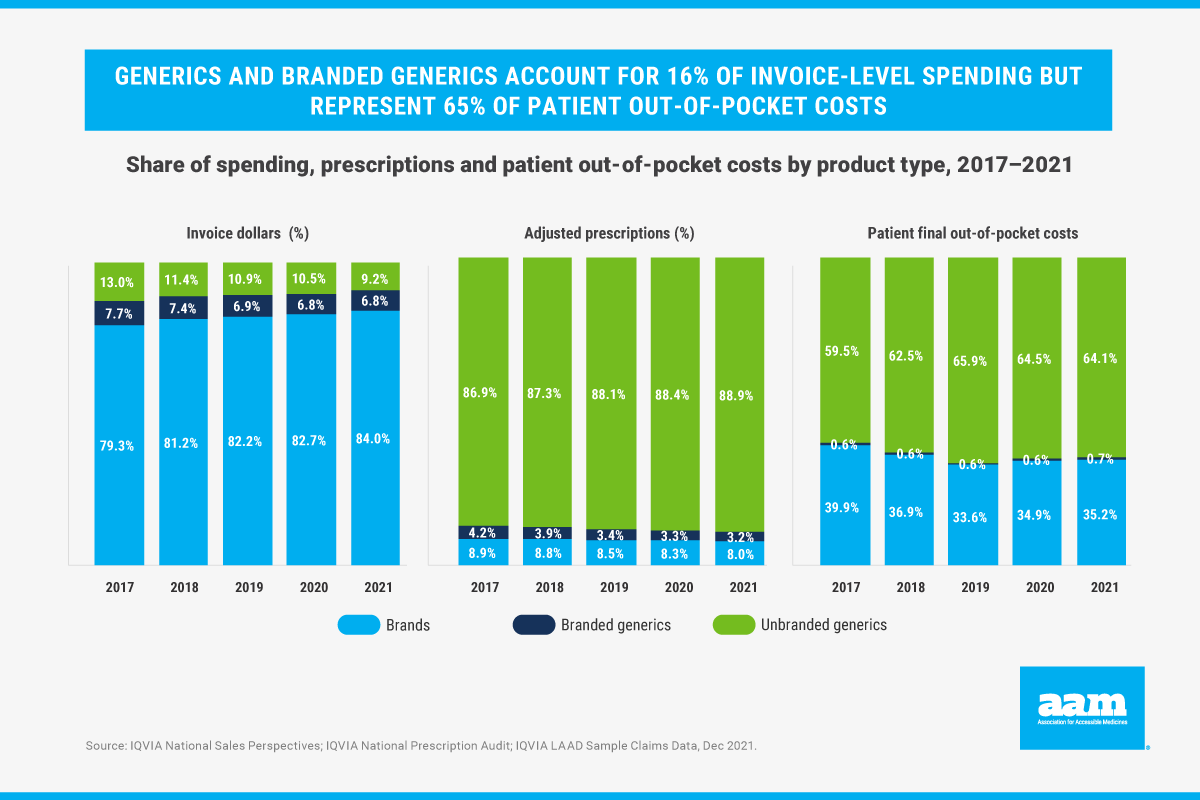

IQVIA found that generics and branded generics have decreased to 16% of invoice-level spending while accounting for an increasing share (92%) of all prescriptions. In fact, over the past five years the generic share of invoice-level spending has dropped from 20.7% to 16.0% while the share of prescriptions has risen from 91.1% to 92.0%.

Surprisingly, the report also noted that generics represent 65% of patient out-of-pocket costs. Put another way, despite the decline in generics’ prices, patients are spending more for these medicines.

This report further reinforces the unmet potential for patients to access affordable medicines. While there are low-cost, effective options available in the marketplace, PBM formulary design too often blocks patient access to generics or biosimilars or forces them to pay more than necessary. And it echoes other such findings, including a report from Avalere noting that nearly half of all Medicare beneficiaries were forced to pay the full cost for their generic drug because of their health plan formulary copays.

Patients purchase their prescription drug insurance – whether from the federal government or from a private plan — with the expectation that they will receive the benefit of the large purchasing volumes their third-party provider possesses to reduce their individual out of pocket costs. While the IQVIA report illustrates that this expectation is left unmet, there are several opportunities for policymakers to bring these savings to their constituents. In particular, Medicare Part D could require that generic drugs are placed on generic tiers consistent with bipartisan legislation introduced by U.S. Representatives David B. McKinley, P.E., (R-W.Va.) and Annie Kuster (D- N.H.).

Further, as new generic and biosimilar drugs enter the market, Medicare could require plan sponsors to review these cost-saving medications and provide justifications to CMS when they are not placed on formulary. An AAM report revealed that it could take up to three years for a new generic to be placed on formulary.

Other steps to mitigate high drug costs for patients include: (1) incentivizing the use of lower cost biosimilars and generics by decreasing plan liability for these products, (2) aligning plan incentives for using low-cost products by decreasing government reinsurance and increasing plan liability in the catastrophic phase and (3) updating Part D regulations to clarify that biosimilars will be treated as generics for purposes of mid-year formulary changes.

To see the full analysis of generic and biosimilar savings, view the report here and additional resources on policy recommendations here.

By Monét Stanford, Director, Policy

Published on May 2, 2022