Something is wrong when America’s patients pay the same or more for an FDA-approved generic version of a high-priced brand drug. It’s even worse when those costs go up each year. Generics provide competition for expensive brand drugs and savings for patients. In 2020 alone, generics and biosimilars have saved the Medicare program $109.6 billion.1

Let’s take a look at what’s going on. In Medicare Part D, medicines are covered on formulary “tiers” where a drug in a lower tier will have a lower copay than a drug in a higher tier. For example, on average a plan may charge as low as $0 for Tier 1 (preferred generics), $5 for Tier 2 (generics), $42 for Tier 3 (preferred brands) and a percentage of the list price for drugs on Tiers 4 and 5.2 The intent is to encourage seniors to use the lowest cost option possible. Because generic drugs are significantly less expensive than their brand counterparts, they have historically been placed on the lowest tier. However, in recent years, even as generics continue to lower their prices, many Medicare Part D plans have chosen to place generics on higher tiers with higher copays.

Higher Tier Placement Costs Patients More

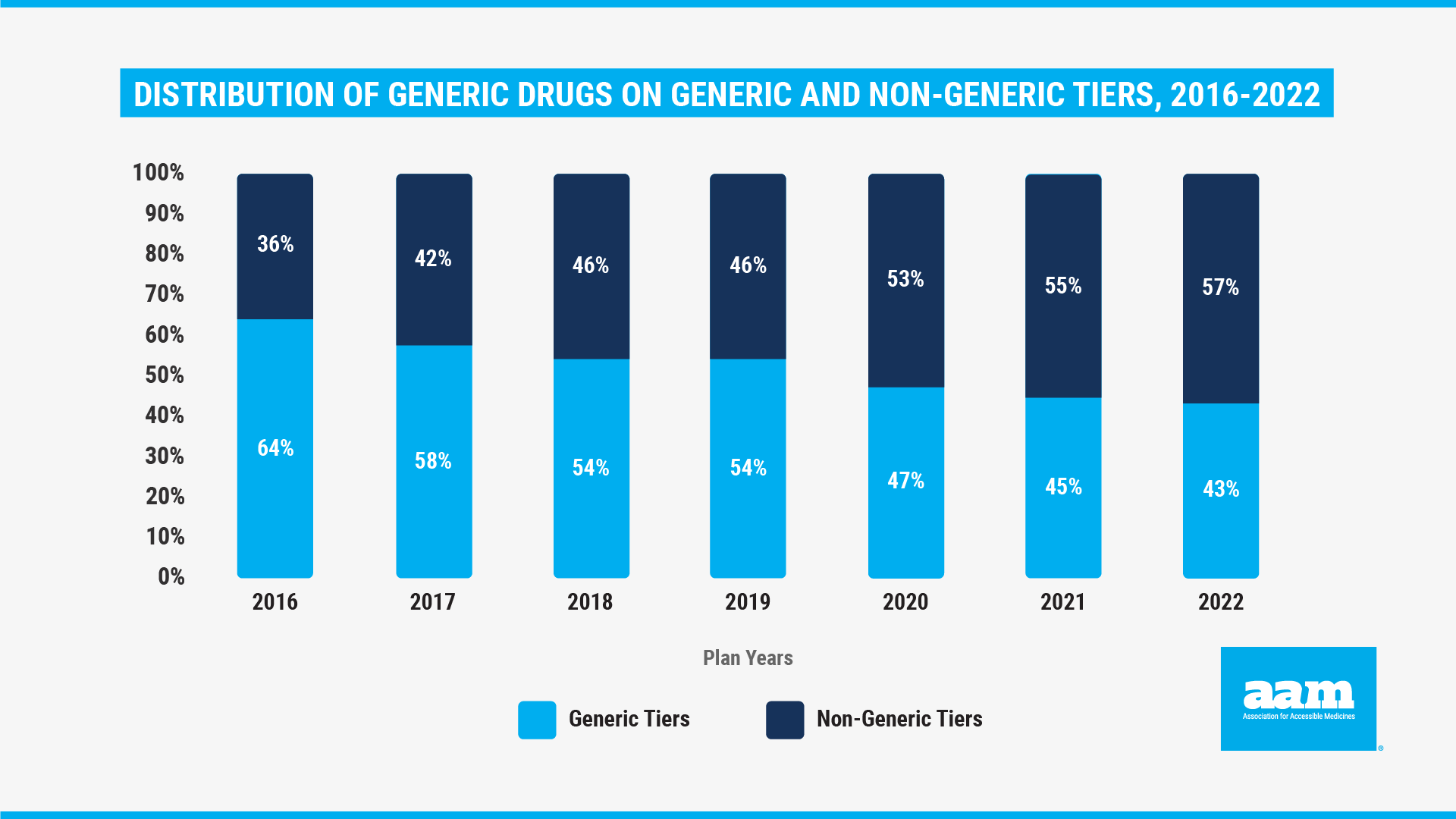

The health care consulting firm Avalere recently examined this puzzling phenomenon. Reviewing generic drug formulary placement by Medicare plans from 2016 – 2022, Avalere notes how plans have taken advantage of the Center for Medicare and Medicaid’s (CMS) flexibility by placing more and more generic drugs on non-generic tiers. For the current plan year, Part D plans placed generics on non-generic tiers more than 57% of the time. This is the third year in a row that more generics are on non-generic tiers than on generic tiers, and it can result in higher out of pocket costs for seniors. In fact, Avalere previously found that, as a result of generic tier placement decisions, nearly half of seniors were forced to pay the full cost for at least one generic. For example, because they were placed on a non-preferred tier, over 87% of beneficiaries paid the full cost for generic cardiotonic (or heart failure) agents, effectively nullifying the value of their Medicare Part D benefit.3

As a result of these practices, seniors are paying more at the pharmacy counter, but it’s important to note that insurance plans and their middlemen are not placing generics on higher tiers because of higher prices. In fact, the Congressional advisory board MedPAC found that the average cost of prescription generic drugs decreased 13.7% from 2006 to 2018 and decreased an additional 11% from 2018 to 2019.4

Perverse Incentives Drive Plan Tiering Decisions

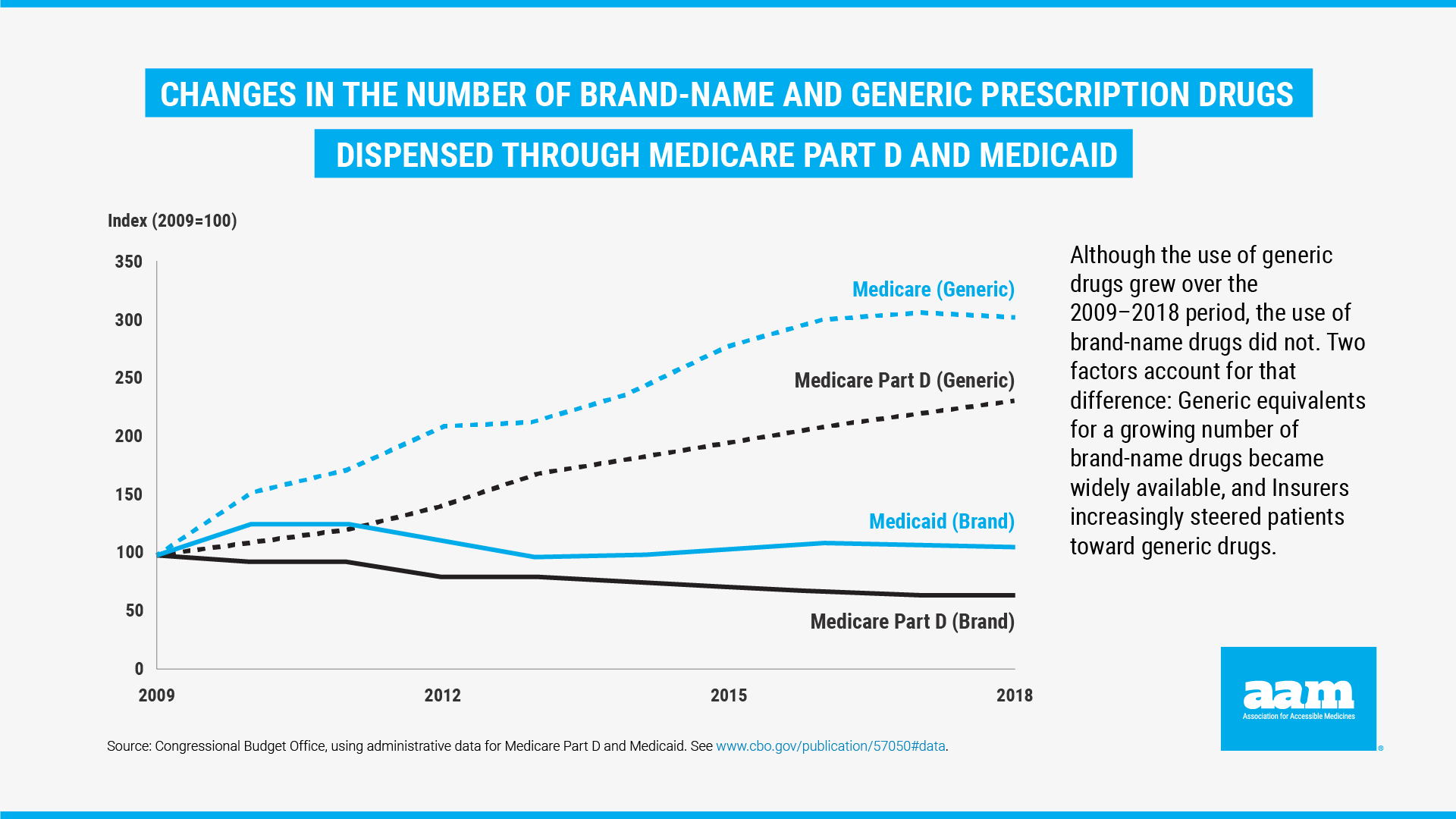

So why is this happening? It appears that this dynamic is simply one more result of perverse incentives embedded in the design of the Medicare Part D program. As Part D insurance plans try to stay competitive and manage rising brand drug prices, they can keep their overall costs low by making patients pay more for their generics. And this is exactly what has happened. According to the Congressional Budget Office’s most recent analysis, the average net price of a prescription for a brand-name drug has more than doubled between 2009 and 2018 from $149 to $353. However, the average price of a prescription for a generic drug fell from $22 to $17. This decline in prices occurred despite, as illustrated below in Figure 2, the increase in the use of generic drugs which jumped from 75 to 90% within Medicare plans.5

Figure 2. Changes in the Number of Brand-Name and Generic Prescription Drugs Dispensed Through Medicare Part D and Medicaid

Figure 2. Changes in the Number of Brand-Name and Generic Prescription Drugs Dispensed Through Medicare Part D and MedicaidConsequently, plans generate more revenue by moving generic drugs onto non-generic tiers with higher copays. But this means that seniors who use low-cost generics are subsidizing those who use high-cost brand drugs and are receiving far less value from their Medicare benefit. The findings in this analysis further emphasizes the need for Medicare Part D plans to mitigate costs for patients by ensuring that generic formulary placement and copays are truly reflective of low generic costs, and for policymakers to advance prescription drug reform initiatives.

By Monét Stanford, Director, Policy

Published on January 26, 2022

References

- Association for Accessible Medicines: The U.S. Generic & Biosimilar Medicines Savings Report 2021 (Link)

- Kaiser Family Foundation – Medicare Part D: A First Look at Medicare Prescription Drug Plans in 2022 (Link)

- Avalere Health Insights & Analysis : Some Part D Beneficiaries May Pay Full Price for Certain Generic Drugs (Link)

- MedPAC: The Medicare prescription drug program (Part D): Status Report. (Link)

- Congressional Budget Office: Prescription Drugs: Spending, Use, and Prices Report – January 2022 (Link)